PODCAST: | “Freedom to Learn:” Florida Families Can Benefit from the New Federal Scholarship Tax Credit

Lauren May on Expanding School Choice, Unbundling Education, & Empowering Parents in Florida

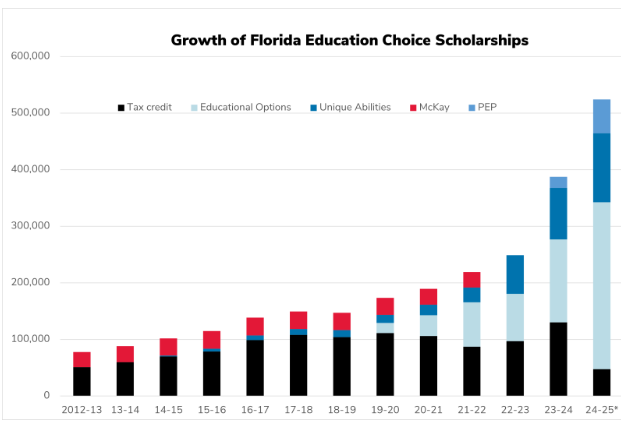

Lauren May, Director of Advocacy at Step Up for Students – the nation’s largest scholarship-granting organization (SGO) – joined the Freedom to Learn podcast to dispel education freedom myths, explain how Florida became a national leader in educational choice, and discuss what to expect from the new Federal Scholarship Tax Credit. Lauren and I talk about the evolution of Florida’s school choice landscape, from small, targeted scholarship programs launched 25 years ago to universal education savings accounts (ESAs) and other programs serving more than 500,000 students today.

Our conversation has been edited for length and clarity. Please follow or subscribe to Freedom to Learn on Spotify, Apple Podcasts, YouTube, or wherever you get your podcasts. New episodes are released every Thursday!

You’re a former educator and school leader. What prompted your transition from the classroom into education freedom advocacy?

Lauren May: When I was in college, I planned to be a lawyer. I was going to go to law school at the University of Florida – go Gators! – and then I started teaching Sunday school, and something started tugging on my heartstrings, and I felt like God wanted me to move in a different direction. So I decided to change my major and go into education. After I graduated, I moved back to Jacksonville, Florida, where I was born and raised.

I worked at an inner city Catholic school where all of our students attended on a scholarship. The scholarships made them eligible to go to that school, and without them, our school wouldn’t be able to be open, and the kids wouldn’t be served. And our kids did really, really well when they graduated from our school. They went on to graduate high school and many of them went to college and beyond.

I later became the principal of that school. When I started learning a little bit more about Step Up for Students and what they do, which is provide scholarships for kids in private school (now we serve a lot of students who are homeschooled or on the Personalized Education Program), I thought, “Wow, this sounds really intriguing. And I would love to come and work at an organization where I can impact even more kids to have choices and options.” So I moved to Step Up about seven years ago, and it has been the most amazing journey to be here and to watch so many students become eligible and use a scholarship to find the educational setting that best meets their needs.

Let’s talk a little bit more about Step Up for Students. What’s a scholarship-granting organization (SGO)? That’s a term we hear a lot these days.

Lauren May: A scholarship-granting organization is an organization that serves to help kids on scholarship programs. In Florida, we call them scholarship-funding organizations (SFO). Our mission is to give families options to choose the educational setting that best meets their needs. We either raise money or we receive money from the government, depending on the program. And then we allow families to have scholarships to either send their child to the private school of their choice, or to homeschool, or to do personalized education learning. Our goal is to give as many families as many options as possible.

Step Up for Students is more than a simple scholarship-granting organization or scholarship-funding organization. It seems like there’s more to it. Or is that it?

Lauren May: We are a scholarship-funding organization, but that in itself is a lot. So it sounds like you just get money and move it. No, not really. We say that we do five main things. We work on applications: Is the student able to apply, and are they eligible? We tell the state, “these are the students that are eligible,” then we decide how much money they can get, then we move it into a scholarship account, which is sort of like a bank account that we manage to ensure that when they are getting dollars, anything that they buy is an eligible expense.

In Florida, there are many, many things that students can buy using their scholarship dollars, but there are some things they can’t. The best example would be school lunch. You can’t use scholarship dollars to pay for your school lunch, but you can use it to pay for school tuition or for your book fees and things like that. And there’s a list of things that they can and can’t do. We ensure that’s in compliance. When they say, “yes, I want to use it for this item,” we determine, “is that an eligible item? Yes or no.”

And they can either buy it on our platform, My ScholarShop, or families can go buy things out and about, and then come back to us with a receipt for reimbursement. We currently have over 20,000 different types of providers in our marketplace. That might be speech therapists, tutors, private schools, or public school districts. We have all these different types of groups of people and vendors who can accept scholarship dollars, and families can use their money with them. We make sure that they’re eligible. And there are lots of different ways you can or can’t be eligible to serve scholarship students. And then we also help our vendors who have items on our marketplace to determine what’s eligible and what’s not based on each scholarship. Because in Florida, some scholarships can get some things, and others cannot.

We’re very diligent on compliance and making sure that everything is done as quickly and as efficiently as possible, but also as safely as possible to ensure that all of our students are able to get what they need, but also that we’re making sure that we keep all of their data and information safe.

Does Step Up play a role in informing families about their options?

Lauren May: Yes, we help market the scholarships. We have a call center so families can call in and ask questions about the scholarship program, or if they have a problem, they can report it to us. Florida’s had a scholarship program for almost 25 years. We still to this day go out and talk to families all across the state about the scholarship programs, and what they do, and find out if their children would be interested.

20 years ago, I was in charge of the state scholarship programs at the Florida Department of Education. In those days, there was the McKay Scholarship Program for students with disabilities and the Corporate Tax Credit Scholarship program; each of them had about 15,000 participants. There was also the Opportunity Scholarship Program, a very small program for students who had been assigned to or were attending a persistently failing school. Unfortunately, the Florida Supreme Court at the time struck that program down.

A lot has changed in the last 20 years, including the program names and certainly the participation numbers. What are the major programs now? McKay is no longer, right?

Lauren May: Yes, the McKay Scholarship was created for kids who had an IEP and a specific disability, and families could decide if they wanted to either move to another public school or to get a scholarship and they could either send their child to private school or home school using that scholarship. McKay turned into what used to be called the PLSA, Personalized Learning Scholarship Accounts. Then it changed to the Gardiner Scholarship. Now it’s called the Family Empowerment Scholarship for Unique Abilities; kids that have specific disabilities that qualify, and they can use that scholarship for either homeschooling their child or sending them to an eligible private school.

It’s been 20 years, but from what I recall, there were adjustments in the allocation to the student based on the level of their need. Is that still the case?

Lauren May: Yes, that’s correct. For FES UA, the scholarship average amount is about $10,000 per kid, but it ranges based on how severe a child’s disability is. So if they need more assistance at school, they get more money. We currently have over 150,000 kids using that scholarship this year, which has increased year over year over year.

For many years, we had a wait list for the FES UA Scholarship. But a few years ago, our legislature allocated more funding for that scholarship. So we have not had a wait list over the past two years.

It’s been so amazing to see so many families take part in the scholarship and give their kids the learning option that is going to meet their needs. We see kids who may have been in public school and really struggled. Now they’re thriving in a homeschool environment or they’re thriving in a private school.

Our largest program, the Family Empowerment Scholarship for Educational Options, is for families who have a child that’s attending a private school. As long as they’re eligible to attend public school in kindergarten through 12th grade, every child in the state is eligible for that scholarship.

The Florida Tax Credit Scholarship is also a scholarship that families can use for private school tuition. But again, we kept having wait list, wait list, wait list. Step Up raised between $700 and $800 million a year for the Florida Tax Credit Scholarship, but we still had families getting on a wait list because there was so much interest.

So in 2018, the legislature and Governor DeSantis enacted the Family Empowerment Scholarship for Educational Options. That funding comes through the state budget as opposed to through the fundraising. We still fundraise for the Florida Tax Credit Scholarship, but we also have money coming to serve all the students that want that scholarship that comes through the state.

And we should remind listeners that Florida does not have a personal income tax. So when you’re talking about raising funds for a tax credit scholarship program, this is not from individual donors. It’s from corporations.

Lauren May: That’s correct. We raise it from corporate donors. We also have the Personalized Education Program that was enacted just a few years ago, and it’s for families who choose to educate their child from home, but they want to have a scholarship to help them. Most of that money is funded through the Florida Tax Credit Scholarship. Families, on average, get about $8,000, and they can use those funds to pay for anything to complement their home education program. It might be that they’re attending some soccer classes or that they need curriculum and books. A lot of them are starting to attend different a la carte learning options. They might attend a private school for one day a week or one class a week, like maybe they’re going to go take Algebra at the local Catholic school, or they can also attend a public school.

Over half of our public school districts now serve as providers for the families across our state who are using the personalized education program and the FES UA Scholarship.

Lots of opportunities to participate both as a family, as a student, and as a provider with 20,000 different providers, including private schools and public school districts. What do those numbers add up to? More than 30,000 from my days, that’s for sure!

Lauren May: We serve over 500,000 students all across the state so that they can have that education option that works for their children. I love working here because I know that we’re making such a difference in so many families’ lives across the state.

If people are listening to this and they think, “wait, that was a lot of programs and a lot of numbers,” where would you direct them to stay up to date on the data?

Lauren May: You can visit nextstepsblog.org to get a lot of really good information and stories about participating families and providers. We just released a white paper by my colleague Ron Matus, and it’s all about Florida’s a la carte learning boom. You can also visit our website, stepupforstudents.org.

You’ve written about how Catholic schools in Florida are growing, which in a way is kind of a miracle.

Lauren May: It is so amazing, and I’ll tell you it’s not a miracle and it’s not by accident that our Catholic schools in Florida are thriving. We have seven amazing, innovative, supportive superintendents who have really bought into the idea that choice is a way to keep our schools open and give our families more options and serve more families.

So across the Catholic landscape in Florida, our schools have seen an enrollment increase every year for the past 10 years, and on average, it’s a 10% increase.

The NCEA, the National Catholic Education Association, releases data every year on the 10 largest states of Catholic school enrollment, and they say how much each of them has grown or shrank. Every single year Florida is growing, and unfortunately, the other states are not.

Florida is a very competitive environment for educators and for schools because we have a very robust charter school system, and our charter schools are really amazing. Many of our public schools are fabulous. They have magnet programs, IB programs, helping the kids go into college and take college courses early. We have a very robust virtual school option for families. So what’s really amazing to me is with all of these options, we’re still seeing our Catholic school enrollment grow.

And that’s because our Catholic schools have really bought into the fact that they are serving families. They partner with parents. They work closely on what the parents and the kids in our school need to make sure we’re serving them well, which is really the ultimate goal of Catholic education. They understand what is needed to be successful and to grow your enrollment in a competitive environment.

And when you’re talking about schools meeting the students’ needs, that includes serving students with disabilities, right?

Lauren May: Yes, the number of students that are attending those schools using the FES UA scholarship, which is for kids with disabilities, has increased every year by like 200%. Each year more and more families are being served who might have a kid with ADHD or maybe a little bit of mild autism. We also have Catholic schools that specifically serve kids with severe disabilities. The Morning Star schools are for children with autism or Down syndrome or other disabilities that may not fit in a typical school.

My kids’ Catholic school is a really good example of a school that’s really serving every kid. They have two learning support teachers full time, and one helps students who are a little bit below grade level and one helps students who are above grade level and they push into the classrooms during center time and work with those students. The data that we’re seeing with how well they’re improving their work is just so great.

It’s such a misconception out there that private schools, that faith-based schools, do not serve students with disabilities. It’s quite the opposite.

Are there other trends that you’re seeing among families who are using these various programs?

Lauren May: One thing that I think is really interesting is how many families I work with who have kids in all different learning options. They may have one child that’s in public school and doing really well in a public high school setting, and then they have a child with a disability who’s better served being homeschooled using the FES UA scholarship, and then they might have two other students who are attending a private school using the FES EO scholarship.

And so we have families that are really unbundling the idea that all my kids need to go to the same place and be served in the same way. That’s not happening in Florida anymore.

We’re seeing families say, this child needs this type of setting and this is where they’re going to thrive, while this child needs something totally different. Families are saying, “what does my child need to succeed and how am I going to make sure they get it?”. And they find a way to do it using our scholarship programs.

And it can change over the course of the child’s educational journey. You don’t become one thing or the other, a private school parent or a public school parent, in a state like Florida. You’re there navigating the options and ensuring that each of your children at each of the stages has the educational opportunity that best meets their needs. Are there barriers that are still in place in Florida for families who want to access educational opportunities?

Lauren May: The barriers that used to exist have really been eliminated, such as in the beginning, you had to have a certain income level to qualify for a scholarship, or you had to attend public school first to qualify for a scholarship. That has all gone away, thank goodness, because now many more families are able to participate. But of course, we’re always educating and helping families know about the program. Even in a state like Florida, I will hear of families on a monthly basis who did not know this scholarship option existed. We work really closely with our private schools across the state. We have a whole team that serves our private schools and goes out and talks to families and helps educate out in the community about the scholarship programs. And we also have our current families who are really our best supporters and our best educators for others because word of mouth works really well. And when they find something that works for their child, they’re really excited and eager to share it.

And so that’s been really neat to get to work with so many families across the state who are so supportive and so thankful that they want to share the good news with everybody they know. Our Next Steps blog has lots of those types of stories of kids and families who are being served really well and who have turned into advocates for the program.

Let’s switch gears and talk about the new Federal Scholarship Tax Credit. Most media coverage focuses on how the tax credit will benefit students in blue states that don’t already have state education freedom programs. Is it your sense that students in Florida will be able to benefit from this as well?

Lauren May: Yes, 100%. We are really excited and eager to help implement this program because we believe it’s going to help so many families. Students who are attending a public school are eligible for a scholarship (supported by the Federal Scholarship Tax Credit) to help pay for tutoring or educational materials. We think that’s going to work really, really well, especially with our partnerships that we currently have with our districts. We think that they’re going to be really excited and eager to find new ways to serve their students.

And then our students that are on scholarship often come to me and say, “hey, I don’t have enough money to cover high school tuition,” because high school tuition is often more than the seven to $8,000 that families get for the private school scholarship. And so we think that a supplemental scholarship to go on top of the [state] scholarship they already have will either help families fully pay tuition or pay tuition closer to what the actual tuition of private school is.

If they’re on the PEP scholarship or homeschooled, we’re still waiting to see if those children are fully going to be eligible. We don’t know because the bill has a couple intricacies that we’re waiting on feedback from the U.S. Treasury Department.

For our students in private school, it can either serve to help pay tuition or they can also use it for tutoring and other educational items. We’re really excited and eager to implement that program for our families because we think it will either supplement the scholarship they have or it’ll be a new opportunity for children in public schools.

You mentioned that we’re waiting to hear back from the Treasury Department on a number of things, and that will come in the form potentially as non-regulatory guidance, but definitely as regulations that will be put out not by the Department of Education, as this is not a new federal education program, but by the US Treasury Department because this is a federal tax credit. Can you talk about the involvement that scholarship-granting organizations are having as part of that rule-making process?

Lauren May: Yes, I attend many different meetings and discussions and coalitions about this exact topic because there are so many people across the nation that are really eager to make sure we get this program right. In Florida, we’ve been doing choice and choice scholarships for almost 25 years,so a lot of the calls are, “How do you do this in Florida? How do you check that every kid is eligible? What do you recommend we do?” And so we’re in those conversations. And then when we look at the bill and we have specific questions about what the bill says or suggestions for how it could effectively be interpreted or implemented, we’re sharing that with those coalitions who are also in discussion with the Treasury Department, as are we, to make sure that when the rule-making process and guidance comes out, it will allow as many students as possible across the nation to be served and served well.

In my decades of working in education policy, I have never seen a topic that has received so many webinars covering it. In addition to the behind the scenes conversations and gatherings and meetings that you’re a part of, there are very publicly accessible webinars that are happening by a wide variety of groups to make sure that people know about the federal scholarship tax credit, that people interested in starting scholarship granting organizations know how to go about doing that, and to ensure that a variety of stakeholders are involved in the rule-making process and in the process of engaging governors and to ensure that they are going to opt in. Do you have any advice for states that might have governors who are on the fence about participating in the tax credit, how to win them over?

Lauren May: I would definitely recommend that you bring families to speak to them and share your family stories. We have families across the state who can talk about how impactful the scholarship has been for their family. Before we got the Family Empowerment Scholarship for Educational Options, we had an amazing woman named Shereka who was sending her three boys to private school in Orlando, but she had to pay out of pocket because her kids were on the Florida Tax Credit Scholarship wait list. Shareka was actually working 60 hours a week driving a garbage truck in Orlando. She was working double shifts in order to cover the tuition because her kids were on that wait list. That story truly impacted so many of our legislators and even our governor.

My best advice is to always center your advocacy around the students and around the families whose lives will be changed for the better and who, hopefully when you give them a scholarship, it’s going to allow their kids to go on and succeed and change the world for the better.

Make sure you center all of your advocacy around the students because they’re the ones that really matter in this and hopefully if we can get as many governors as possible to say yes, we’ll be able to serve lots and lots of kids who may not have an effective learning environment if not for a scholarship.

Is there a primary component of the federal scholarship tax credit implementation that you feel really needs careful attention?

Lauren May: Well, to be honest with you right now, my number one excitement and concern at the same time is “how are we going to raise the money?”, because the federal scholarship tax credit only allows donors to give $1,700 to get a tax credit. If you donate $1,700, you’ll get that tax credit back the next year. And that’s not that much money. Hundreds of thousands of donors, hundreds of thousands of taxpayers need to understand why the tax credit is important and how it’s going to change kids’ lives and hopefully change the world, and also be willing to donate. To me, that’s the number one thing we want to focus on: what’s going to be the most effective ways to get as many people as possible on board to donate so that we can serve as many kids as possible.

As we wrap up, our guests help to dispel myths around around education freedom. What is the myth that really bugs you the most that you’d want to tackle today?

Lauren May: One of the big ones is the claim that when you have scholarships, kids just use them to pay for private schools and all the private schools get rich and that’s what it is. That is not at all what we’re seeing in Florida. We have over 150,000 children using some type of a la carte learning experience in our state, using their scholarship dollars to pay for public school classes, to pay for virtual school classes, to attend a PE class at a private school. And it is so exciting to see that happening.

We call it unbundling. They’re unbundling their education so that their kids are getting what they need and in a way that is going to meet their needs effectively.

When I hear people claim “this is just another private school scheme,” that is not the case at all. Education savings accounts (ESAs) allow families to really pick and choose what parts of an education they want to use those dollars for. And it’s been really, really exciting and enriching to see so many really neat programs popping up across our state. And I’ll just very briefly tell you about one of them. In Fort Lauderdale, there’s a program called Surf Skate Science where kids do surf and skating lessons using their scholarship dollars, but it’s all tied into math and science. They’re learning really tricky math, physics, and things while being outside and kids are really responding amazingly to it. And so those are the type of things that we’re seeing across our state where people are starting to realize that sitting in a seat and getting taught the same thing for all 20 kids in a classroom may not be effective for everyone. It is effective for some, but not for everyone. so giving families those options, giving kids those opportunities is really, really exciting. And that’s the myth that I would like to bust today because I believe that choice empowers, choice gives so many options. And like I said earlier, I really think that if we give families the right choices and the ability to pick them so that their kids can succeed, that’s how we’re going to change the world.

How can people follow your work?

Lauren May: I usually post updates on my LinkedIn page. Follow our Step Up for Students social media pages, we also post updates there. On our blog, nextstepsblog.org, you’re able to subscribe to different listservs and learn about different things going on and we’ll send you emails with updated articles and things like that.

Related

BLOG: DFI Participates in the White House School Choice Roundtable

By Ginny Gentles It was an honor to join Education Secretary Linda McMahon at a White House school choice roundtable during National…

PODCAST: | “Freedom to Learn:” Darla Romfo on Putting Kids First, Building a Scholarship Granting Network, & Engaging in Federal Scholarship Tax Credit Rulemaking

The federal tax credit for donations to scholarship-granting organizations could expand the Children’s Scholarship Fund’s…